Are You Better Off Financially Than Your Parents Were At Your Age?

We are the first generation in the history of America, to be worse off financially than our parents. Every other generation, since the founding of our country, has been better off than their parents were. Most have been much better off.

Why is this happening?

The Left will say it’s due to economic inequity, but what does that really mean? Their talking point will be that the rich are getting richer, and everyone else is getting poorer. Actually that isn’t true, nor is it the reason we as a generation have less spendable income than our parents.

The Right will say that wages just haven’t kept up with the cost of living. This is true, but why not? Why is everything so much more expensive than it used to be?

When I was a kid in the 70’s, a new car might cost you $2,000. A new Cadillac in 1970 was around $6,000. When Henry Ford introduced his Model-T in 1908, it sold for a whopping $600, brand new. It took 62 years for the price to increase about four times, from $600 to around $2,000. Today, 50 years later, the price for a 2020 Ford Escape is just under $25,000. That’s an increase of 12.5 times.

The price of a car has gone up 12.5 times in the last 50 years, when it didn’t quite quadruple in the prior 62. That’s called an exponential increase. I’m using the price of a car because it’s something everyone can relate to, but it’s not just cars. The price of everything has increased just as much.

Why?

Now comes the boring dry part. I will do my best to make it interesting and entertaining, because this is something you should know and understand. This is something every American should know and understand! I promise, there will be videos!

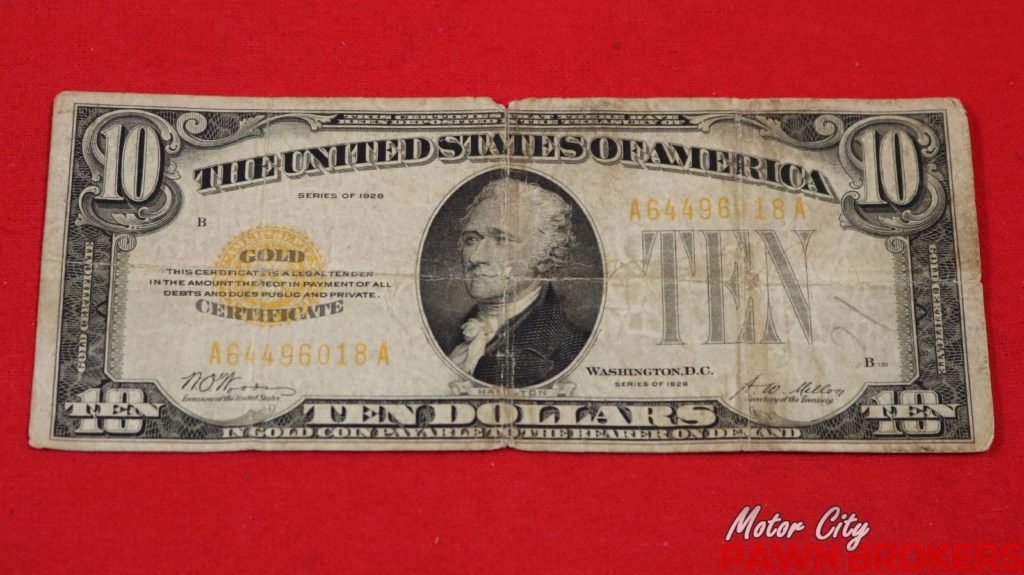

Before the 20th Century, America was on what was called the Gold Standard. That meant that every dollar was backed by exactly $1 worth of gold. In fact, printed at the bottom of every bill were the words “IN GOLD COIN PAYABLE TO THE BEARER ON DEMAND”. That’s why the Government built the Gold Depository at Fort Knox, to store all the gold used to back our money.

Before the 20th Century, America was on what was called the Gold Standard. That meant that every dollar was backed by exactly $1 worth of gold. In fact, printed at the bottom of every bill were the words “IN GOLD COIN PAYABLE TO THE BEARER ON DEMAND”. That’s why the Government built the Gold Depository at Fort Knox, to store all the gold used to back our money.

You could go to any bank, and convert your paper money into gold coins. Try asking for (or even selling) gold at a bank today. I know, I tried selling a gold coin at my local bank. The teller had no idea what he was holding.

Two things happened, that caused this. First, the U.S. began moving away from the Gold Standard. Small steps at first. What was $1 of gold for every $1 bill was changed to $20 of gold for every $50 of paper money. Then it was $50 of gold for $100 of paper money, and so on.

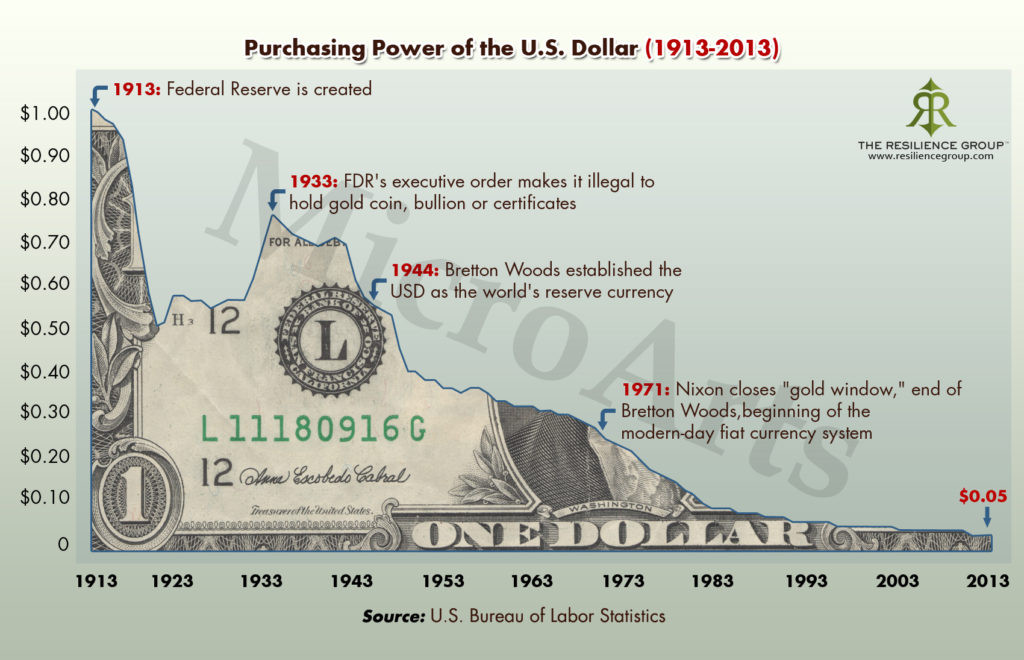

Second, in 1913, the Government created the Federal Reserve Bank. The Fed is theoretically not part of the US Government, but the President appoints all of its Directors and they determine how much money gets printed by the Treasury. Jerome (Jay) Powell is currently the Chairman of the Federal Reserve, and was appointed by President Trump in February 2018. Mr. Powell is in charge of monetary policy for the United States.

The reason for creating the Federal Reserve, was twofold. One, it was used as a way to devalue paper money away from the Gold Standard. The other reason was to try to manipulate the economy in a more direct way. By creating and setting interest rates, along with other “controls”, including the printing of money, the Fed tries to manipulate the economy in order to keep it from crashing.

The problem, of course, is that no Government agency has ever been able to do what they said they would do. As a perfect example of Government efficiency, I give you the DMV. Over the years, America got farther and farther away from $1 of gold backing $1 of paper money, until in 1971 President Nixon was forced to take America completely off the Gold Standard. This is what caused the high inflation of the 1970’s. If you aren’t old enough to remember, ask your parents.

It also allowed the government to print as much money as it wanted. Since paper money was no longer bound to the price of gold in any way, there was no longer a limit to how much could be printed. When a currency isn’t backed by anything but the faith that others will give you something of value in return for it, that currency is called fiat.

Within a decade, the entire world had gone off the Gold Standard, and every country was printing fiat money. Fiat money is created through debt. If you want to learn more about how this is done, there are a series of videos on YouTube, called The Hidden Secrets of Money. Episode 4 talks about how money is created. Mr. Maloney would like you to buy gold and silver from him, but that in no way invalidates the accuracy of the information he gives you.

At first, the Government tried to be responsible about it, printing only money that we could cover (based on the gold to paper ratio we had been using at that time) with the gold reserves we had in Fort Knox.

That lasted about 10 years. In the 1980’s, President Reagan started what is called Deficit Spending. Basically, spending more than you have. It allowed America to buy things we couldn’t afford. This is something that every American should understand is bad. It is how you get massively into debt, which is of course, exactly what happened. When Ronald Reagan left office, the National Debt was a few billion dollars and he worried that small debt was too much.

Deficit Spending allowed the US to buy all the latest and greatest toys for the military. It also allowed us to spend billions on research into the “Star Wars” defense initiative. Don’t get me wrong, a lot of very good things came out of this spending, like the GPS you use in your car and on your phone, not to mention all the streaming services you have on your TV. The problem was, we didn’t have the money for all this stuff. We had to go further into debt, to print more money, to pay for all this cool new stuff.

What happens when the supply of something is greater than the demand for that something? The price drops. It becomes worth less than it was. The value decreases. When it is money that the value is decreasing on, we call that Inflation. The money supply is inflated. The more money that is printed, the less value each dollar has. This is Inflation. America first became really aware of Inflation in 1971, not at all coincidentally to the second that President Nixon took us completely off the Gold Standard.

I was only 7 years old, but I remember the newscasts of the early 70’s. Every night it was first the war in Vietnam, followed by rampant Inflation and fears of where it would lead. After 1974 it was just about Inflation. By the late 1970’s, Inflation ceased to be a buzzword, but then we had the whole Iranian Hostage thing going on.

The Deficit Spending that President Reagan began, only increased. As always, slowly at first, but every new generation finds it easier and easier to follow bad habits started by prior generations. When talking about Presidents, a generation is every 4 to 8 years. President George H.W. Bush increased Deficit Spending, as did President Clinton. By the time George W. Bush was in office, the Roaring 90’s with their Dot Com Bubble, were over. The market crashed hard. Then 9-11 happened, and the market crashed even harder. The Money Machine was turned on to offset the collapse.

Near the end of his term, President Bush bailed out the banks when the financial meltdown happened. Actually, he forced banks that were not in trouble, to take money, so that he could hide which banks were actually being bailed out. He said the banks were “too big to fail”. How did he bail these banks out? He printed more money!

Instead of letting poorly run banks fail, as they should have, he set the precedent that if a bank (or any other major corporation) falters, even through their own ineptness, the Government will fix it. Hence, why we now have the same banks, doing the same things that caused them to fail just 10 years ago. The head of the Government has shown that there are no consequences, if you are a large conglomerate!

His reasoning was that if he had let the banks fail, it would have pushed us deep into Depression. That’s probably true, but we would have come out of it by now, much better off fiscally than we currently are, even though we are currently at the end of the longest economic boom in history.

President Obama inherited the financial meltdown of 2008. What did he do? He printed more money! It worked for Bush, so why wouldn’t it work for him as well? Amazingly, it did and all it cost was $20 trillion in debt!

This is why a dollar that was worth 100 pennies 100 years ago, is now worth 2 pennies. To bring it all back around, the fact that a dollar is now worth only 2 pennies, is why a car that cost $600 in 1908 now costs $25,000.

If you’ve made it this far, congratulations! You are now more financially literate than 99% of Americans. You also understand why the current economic boom is so anemic. Even though it is the longest Bull Cycle ever recorded (It started in 2009), it is built on Government spending and money printing, not actual production.

President Trump is going to do everything he can, to keep the economy up until the election. He knows that a recession will cost him re-election. The problem being, that it was always a weak recovery, built only on Government intervention. When it tanks, it is going to be massive. Worst of all, at this point there’s probably nothing anyone can do to avoid a depression greater than what our grandparents experienced in the 1930’s.

What we can do, is start setting the groundwork to keep another Greater Depression from ever happening again. To do this, we must stop the spending. The House of Representatives holds the purse strings of the nation. They are responsible for letting things get out of control. They are also the only people that can fix the problem, but those who are currently in office have shown that they won’t. Both Republicans and Democrats have shown that all they know how to do, is spend.

Tl;dr: Everything is more expensive due to inept Government money manipulation. A dollar today is worth only 2 pennies because the Government has printed way too much money, so it costs more of those worthless dollars to buy the same things that used to cost less.

Conclusion:

It’s time to try something different. That is why I am running for office and asking for your vote. As your Representative, I will vote against all the spending. I will do my best to create alliances with other Representatives who feel the same way I do, creating a Voting Bloc. With a big enough voting bloc, change can happen!

One person can make a difference, when working with others. That one person is you, voting with others, to send me to Congress.